Start your trading journey with EC Markets

With more than a decade of experience, EC Markets empowers your trading journey through innovation, trust, and confidence.

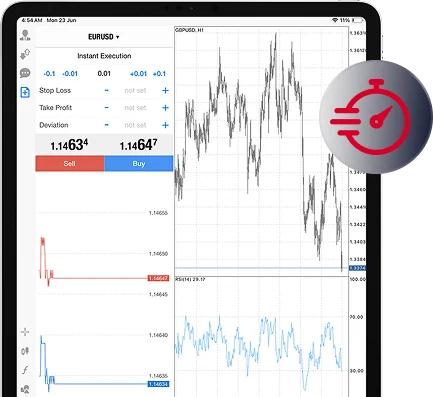

0.004

Average execution speed

95.71%

Executed at the requested price or better

99%

Successful execution

*Statistics generated from EC Markets group of companies

Very low

trading spreads

EC Markets collaborates with numerous banks, liquidity providers,

and other financial institutions, offering highly competitive trading

spreads. Our low-latency enterprise-level servers ensure swift

order execution, providing you with advantageous trading prices.

The spread for major forex currency pairs can be as low as 0.0 pips.

Efficient order execution

All trading orders at EC Markets are processed by our automated order execution system without manual intervention. This system ensures efficient order execution for traders, with an average speed of less than 0.004 seconds. Our partnerships with multiple banks and liquidity institutions provide unparalleled market depth.

Dynamic

leverage

EC Markets offers a new dynamic leverage framework that allows clients to employ ratios of up to 1:1000 while embedding real-time, automated risk-management mechanisms. The initiative addresses the core demand of modern brokerage, delivering genuine capital efficiency without undermining systemic stability.

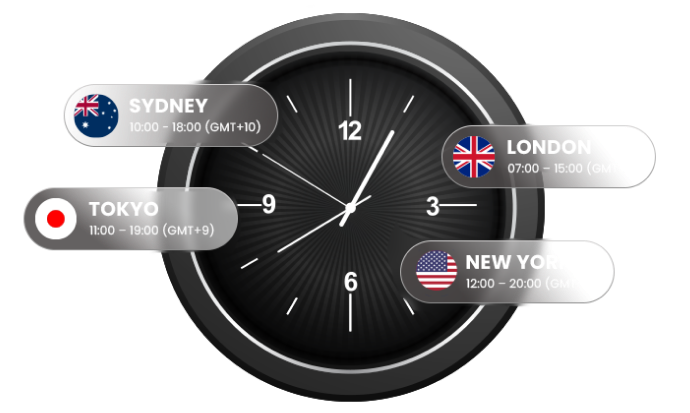

Product trading

time

EC Markets offers users a diverse range of trading products, each with its own specific trading hours. Traders can easily check these hours through the MetaTrader trading terminal. Additionally, our 24-hour online customer service is available to provide information on trading times whenever needed.

Competitive

swap rate

Swap rates apply when holding a position overnight, reflecting the spot price and interest rate difference. Our competitive swap rates helps you reduce costs / boost profits. Adjustments occur daily at 00:00 (GMT+2; note DST). Because interest is settled two days later, holding positions from Wed to Thur incurs three days’ interest (Fri–Sun), settled on Monday.

Why choose EC Markets

Compliant with regulation

You are trading with a fully regulated and licensed broker, operating under the oversight of one of the world’s most respected regulators, the FCA.

Excellent trading conditions

Trade with tight spreads starting from 0 pips, leverage up to 1:30, minimal slippage, and more.

Reliable funding methods

Enjoy fast deposits and withdrawals with credible and reliable funding methods.

CFD trading involves a high risk of loss.